In a world driven by data and numbers, sometimes the statistics can paint a chilling picture of reality. As we approach the year 2024, the latest figures on fraud, debt, car prices, and more are nothing short of alarming. Join us as we delve into the unsettling statistics that are shaping our financial landscape in the coming year.

The Rise of Financial Fraud: How to Protect Yourself

In 2024, the world is facing a concerning rise in financial fraud, with scams targeting individuals across all demographics. According to recent statistics, over $2 billion have been lost to various forms of online fraud this year alone. From phishing emails to fake investment schemes, scammers are becoming more sophisticated in their tactics, making it essential for individuals to stay vigilant and protect their assets.

Moreover, the national debt continues to skyrocket, reaching over $30 trillion in 2024. This staggering figure poses a significant threat to the economy and individual financial stability. In addition, car prices are at an all-time high, making it challenging for consumers to afford reliable transportation. With these alarming trends on the rise, it is more important than ever for individuals to educate themselves on financial security measures and take proactive steps to safeguard their finances.

The Growing Burden of Debt: Strategies for Managing Financial Obligations

In 2024, the world is facing an alarming increase in fraudulent activities, which are contributing to the already growing burden of debt. With more people falling victim to scams and identity theft, it is essential to stay vigilant and protect yourself from financial fraud. Utilize tools such as credit monitoring services and regularly review your financial statements to catch any suspicious activity early on.

Another concerning trend is the skyrocketing prices of cars, making it challenging for individuals to afford their dream vehicles without taking on significant debt. To manage this financial obligation, consider exploring alternative transportation options such as public transportation or carpooling. Additionally, creating a budget and saving up for a down payment can help lessen the impact of car prices on your financial well-being.

Shocking Trends in Car Prices: Tips for Car Buyers

Car prices in 2024 have seen a drastic increase, shocking both seasoned car buyers and industry experts alike. According to recent statistics, the average price of a new car has surged by over 15% compared to the previous year. This alarming trend has left many consumers struggling to afford their dream vehicles, with some even resorting to taking on substantial debt to make their purchases.

Additionally, reports of fraudulent practices in the automotive industry have been on the rise. From inflated sticker prices to hidden fees, car buyers are facing more challenges than ever when trying to navigate the market. To help prospective buyers make informed decisions, it’s crucial to stay informed about these developments and to carefully research all options before committing to a purchase. Keep an eye out for reputable dealerships and always be wary of deals that sound too good to be true.

Addressing Other Disturbing Statistics of 2024: Solutions for a Better Financial Future

One alarming statistic of 2024 is the rise in financial fraud cases, with reports showing a significant increase in scams targeting individuals and businesses alike. From identity theft to elaborate Ponzi schemes, the financial landscape is becoming increasingly treacherous for consumers. To combat this growing threat, it is essential for individuals to stay informed and vigilant, utilizing tools such as credit monitoring services and practicing safe online habits.

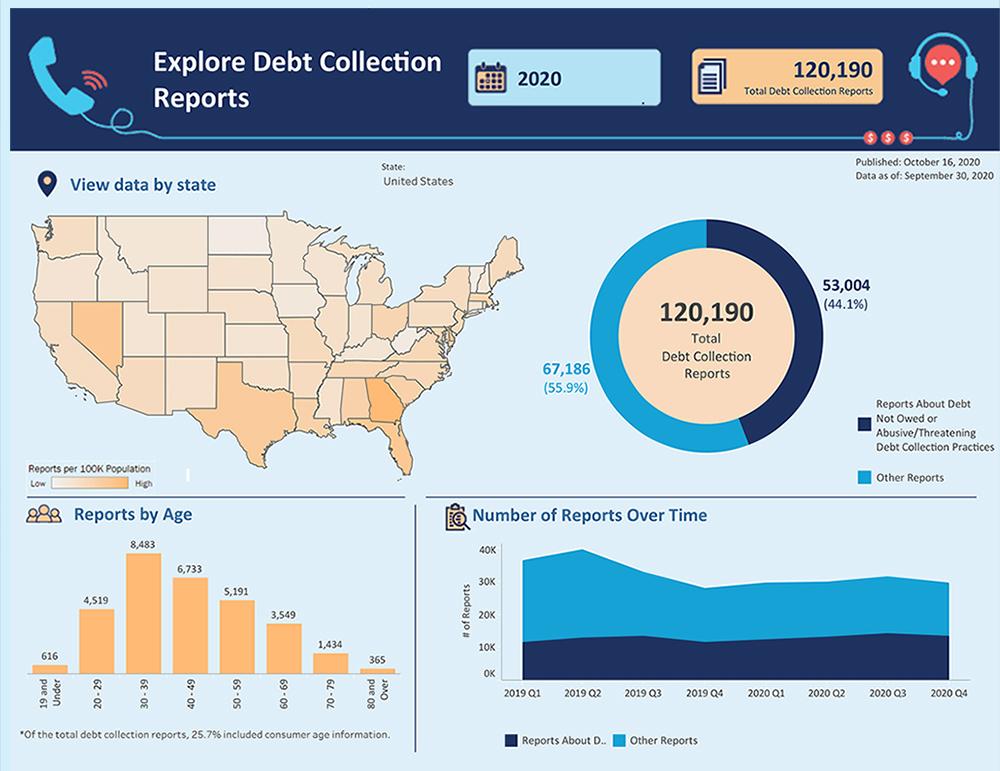

Another concerning trend is the mounting debt levels among households, with many struggling to stay afloat amidst rising costs of living. As personal debt reaches record highs, finding sustainable solutions becomes imperative. Implementing effective budgeting strategies, seeking debt counseling services, and exploring debt consolidation options can help individuals regain control of their finances and work towards a more stable financial future. Additionally, educating oneself on financial literacy and making informed decisions when it comes to borrowing money can prevent further debt accumulation.

Final Thoughts

As we navigate through the intricacies of financial data and alarming statistics, it is crucial to remain informed and vigilant in protecting ourselves from potential scams and pitfalls. By understanding the trends and patterns outlined in this article, we can better equip ourselves to make informed decisions and safeguard our financial well-being. Let us arm ourselves with knowledge and remain cautious in the face of uncertainty. Stay informed, stay safe, and stay empowered.