Are Veteran Benefits Taxable? Everything You Need to Know

Navigating the complex world of veteran benefits can be a daunting task for many individuals. One common question that often arises is whether these benefits are subject to taxation. In this comprehensive guide, we will delve into the intricacies of veteran benefits and provide you with all the essential information you need to know. From disability compensation to educational assistance, we will explore the various types of benefits available to veterans and the tax implications that may come with them. Join us as we demystify the taxability of veteran benefits and empower you with the knowledge to make informed decisions regarding your entitlements.

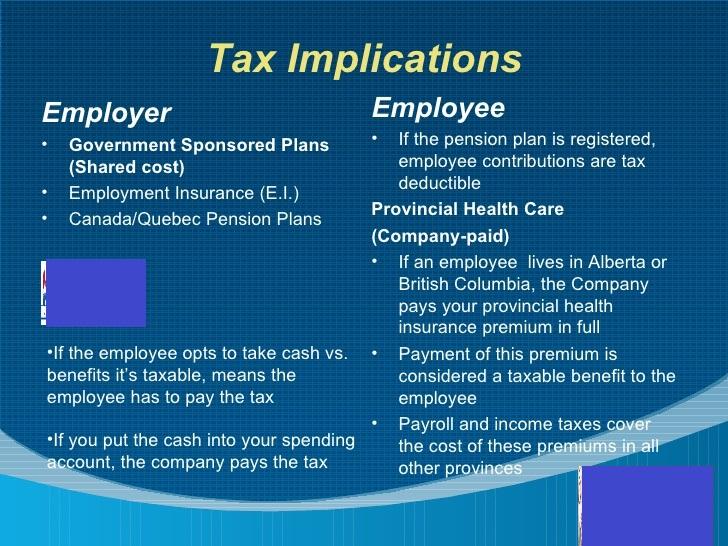

Understanding the Tax Implications of Veteran Benefits

Veteran benefits can have a significant impact on a person’s financial situation, but it’s important to understand the tax implications that come with them. In general, most veteran benefits are not taxable, which means that you won’t have to report them as income on your tax return. However, there are some exceptions to this rule. For example, if you receive disability benefits from the Department of Veterans Affairs, these are usually tax-free. On the other hand, if you receive a pension from the VA, this may be taxable depending on your circumstances.

It’s also worth noting that some veteran benefits may have indirect tax implications. For example, if you receive a housing allowance as part of your veteran benefits, this could affect your eligibility for other tax credits or deductions. It’s always a good idea to consult with a tax professional to ensure that you’re maximizing your tax benefits while avoiding any potential pitfalls. With the right knowledge and guidance, you can make the most of your veteran benefits without running into any unexpected tax issues.

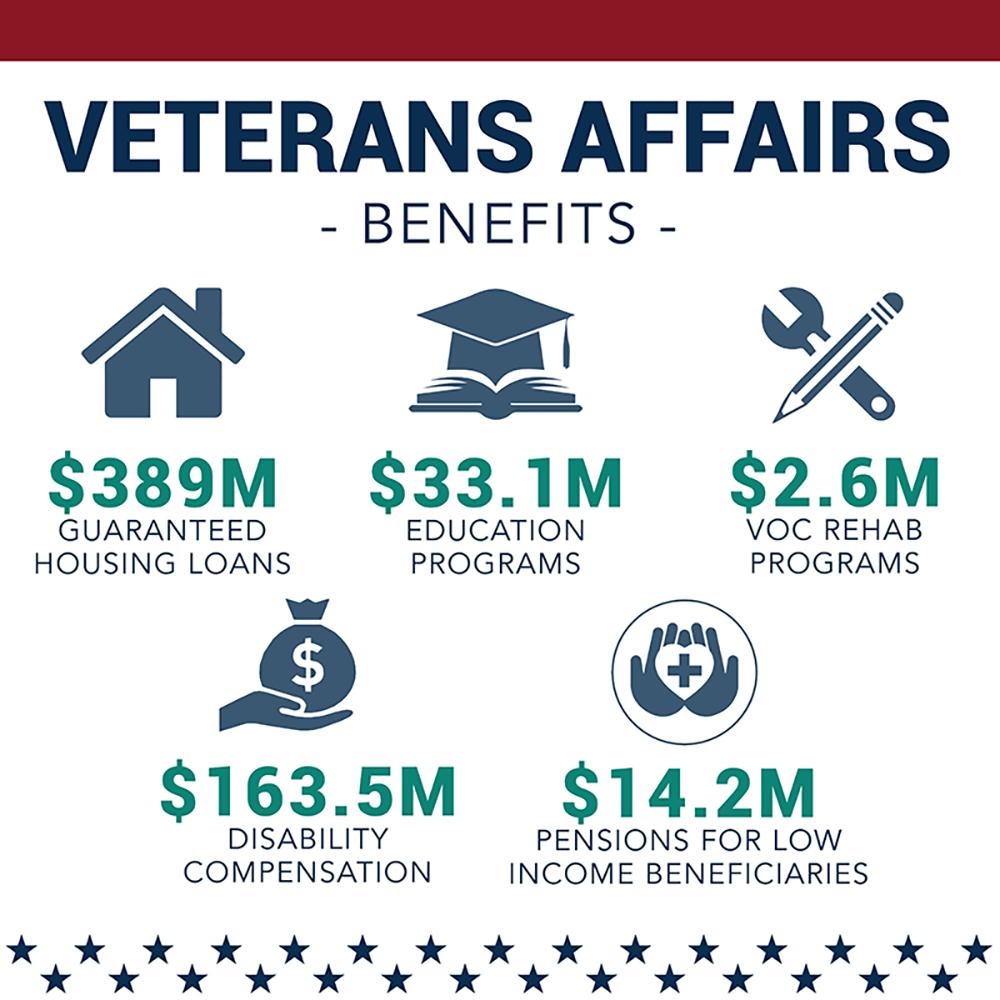

Breaking Down the Different Types of Veteran Benefits

Did you know that not all veteran benefits are taxable? Understanding which benefits are taxable and which are not can save you time and money when it comes to filing your taxes. Here is a breakdown of the different types of veteran benefits:

- Disability Compensation: Disability compensation paid by the Department of Veterans Affairs (VA) is not taxable. This includes any benefits paid to veterans with service-related disabilities.

- Pension: VA pensions are generally taxable, except for those paid to veterans or their families based on financial need.

- Education and Training Benefits: Most education and training benefits provided by the VA are not taxable, including the GI Bill and Vocational Rehabilitation and Employment program benefits.

It’s important to note that while most veteran benefits are not taxable, there are some exceptions. For example, VA benefits for non-service-related disabilities, such as pension benefits for non-service-related disabilities, are generally taxable.

| Benefit Type | Taxable |

|---|---|

| Disability Compensation | No |

| Pension | Yes (in most cases) |

| Education Benefits | No |

Navigating the Complex Rules Surrounding Taxation of Veteran Benefits

When it comes to navigating the complex rules surrounding the taxation of veteran benefits, it’s important to have a clear understanding of how these benefits are treated by the IRS. In general, most veteran benefits are not taxable and are therefore considered tax-free income. However, there are some exceptions to this rule that veterans should be aware of.

One important exception to note is that disability benefits received by veterans are typically not taxable. This includes both disability compensation and pension payments. On the other hand, survivor benefits may be taxable depending on the specific circumstances. It’s crucial for veterans to carefully review their benefits and seek advice from a tax professional to ensure compliance with tax laws.

Maximizing Your Tax Savings Through Proper Reporting of Veteran Benefits

In order to maximize your tax savings through proper reporting of veteran benefits, it is crucial to understand whether these benefits are taxable. Generally, veterans’ benefits are not taxable but certain exceptions apply depending on the type of benefit received. Disability benefits, for example, are usually not taxable whereas military retirement pay may be subject to taxation. To ensure accurate reporting, it is essential to familiarize yourself with the specific tax implications of each benefit received.

Properly categorizing veteran benefits on your tax return can significantly impact your overall tax liability. By correctly identifying whether benefits are taxable or non-taxable, you can potentially minimize the amount of tax owed and maximize your savings. Consulting with a tax professional or utilizing tax software can help navigate the complexities of reporting veteran benefits and ensure compliance with tax laws. Remember that accurate reporting is key to optimizing your tax savings and avoiding potential penalties from the IRS.

Expert Tips on Minimizing Taxable Income from Veteran Benefits

One important aspect to consider when it comes to veteran benefits is whether or not they are taxable. Many veterans are unsure of the tax implications of their benefits, and it is essential to understand how to minimize taxable income from these benefits. By following expert tips and strategies, veterans can effectively reduce their taxable income and maximize their financial resources.

One key tip to minimize taxable income from veteran benefits is to take advantage of deductions and credits available to veterans. By carefully documenting and categorizing expenses related to medical care, education, and housing, veterans can lower their taxable income significantly. Additionally, veterans can explore options such as contributing to retirement accounts or investing in tax-deferred savings plans to further reduce their taxable income. By staying informed and proactive in managing their finances, veterans can ensure that they are not overpaying on taxes and are making the most of their benefits.

Closing Remarks

understanding the tax implications of veteran benefits is crucial for veterans and their family members. By being aware of which benefits are taxable and which are not, individuals can better plan for their financial future and avoid any unexpected tax liabilities. It is important to consult with a financial advisor or tax professional to ensure that you are correctly reporting your veteran benefits and taking advantage of any available tax breaks. By staying informed and proactive, veterans can make the most of their benefits and ensure their financial well-being for years to come.